Why Every Marketer Should Know the Rule of 40

And how it can bring you closer to the CFO, the CEO, and the strategic conversations that matter.

“If you want a seat at the table, learn the language of the boardroom. And in high-growth, high-investment businesses, that language is the Rule of 40.” - Emma

Most marketers aren’t taught financial fluency.

We’re taught funnels, not EBITDA.

We’re fluent in brand tracking, but not burn rate.

We can deconstruct a value proposition in seconds, yet struggle to explain how marketing drives valuation.

We have a lack of financial literacy in our profession, which leaves a systemic gap.

If you want to be heard in the boardroom, make a case for brand investment, defend long-term strategy, and position marketing as a driver of commercial performance, you need to understand the Rule of 40.

It’s the single most powerful metric to help connect your marketing strategy to business value in growth-stage companies.

What is the Rule of 40?

The Rule of 40 is a simple formula used by investors, CEOs, CFOs, and board members, especially in SaaS, tech, and increasingly healthtech and biotech, to assess whether a company’s growth is sustainable and investment-worthy.

It works like this:

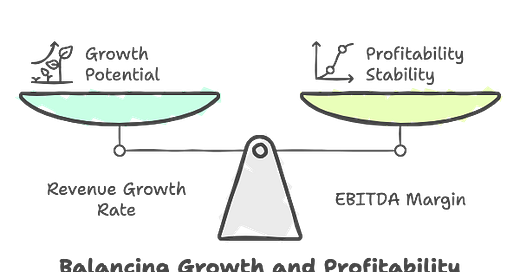

Revenue Growth Rate (%) + EBITDA Margin (%) = Rule of 40 Score

If the result is 40% or above, the company is considered financially healthy.

That’s it.

If you're growing fast but not profitably or profitable but not growing revenue, the Rule of 40 offers a balanced way to measure trade-offs and capital efficiency.

Examples:

A company growing 60% year-on-year with an EBITDA margin of -20% = Rule of 40 Score of 40%

A slower-growth company growing 15% with a 30% EBITDA margin = Rule of 40 Score of 45%

A business growing 20% but losing 10% EBITDA = Rule of 40 Score of 10% (not great)

Why should marketers care?

Because it’s the clearest framework for aligning work to business outcomes and for making the commercial case for brand.

If you're in a high-growth environment, especially pre-IPO, investor-backed, or PE-owned, understanding the Rule of 40 is your strategic armour.

Here’s how it can help you:

1. Speak the language of the CFO

When you frame your strategy or plans in a bid to improve the Rule of 40, you’re talking business performance, not just marketing. And this opens doors to better conversations, bigger budgets, and stronger partnerships with your key internal stakeholders.

2. Position brand as a performance enabler

The best marketers can show how brand impacts valuation, cost of acquisition (CAC), and growth quality. When you improve brand or company reputation, trust, and distinctiveness, you're not only fuelling leads but lowering CAC and supporting premium pricing. Both of which increase EBITDA.

3. Build trust with the CEO and investors

CEOs are under pressure to manage burn, scale efficiently, and hit growth targets. When you demonstrate that your marketing plans contribute to both growth and margin over time, you move away from being a cost centre to the business and become an asset.

Where brand fits into the Rule of 40

Brand building is often mislabelled and is the first expense to be cut in challenging times, because its impact is lagging, not leading. But its commercial impact becomes clearer when viewed through the Rule of 40 lens.

Strong brand = lower CAC

Customers convert faster, sales cycles shorten, reliance on performance media drops.Strong brand = pricing power

Which flows straight to margin.Strong brand = talent magnetism

Which reduces recruitment costs and attrition.

All of these contribute directly to the sustainable growth + efficient margin formula that the Rule of 40 demands.

How to apply the Rule of 40 to your marketing leadership

1. Ask for the numbers

Start by asking your CFO or commercial lead:

What’s our current growth rate?

What’s our EBITDA margin?

What Rule of 40 score are we tracking to?

This one question alone earns you credibility.

2. Audit your marketing impact

How is your team driving revenue growth? Think awareness, acquisition, expansion.

How are you contributing to margin protection? Think brand equity, owned channels, efficiency.

3. Frame your marketing plans accordingly

Instead of: “We need £500k for brand work.”

Say: “This £500k investment is expected to reduce CAC by 20%, improving EBITDA margin by X%. That helps us hit our Rule of 40 target while protecting long-term growth.”

4. Use brand metrics as financial signals

Brand awareness = future demand

NPS = pricing power

Share of search = market momentum

Branded traffic = reduced reliance on paid media

Tie these to performance goals wherever possible.

Bringing it to life

A client of mine, a scaling healthtech business, was pushing hard on growth but burning cash at an alarming rate. Marketing was under pressure to cut costs, stop brand work, and double down on direct acquisition.

Instead, I worked with the marketing lead to partner with finance to understand the company’s Rule of 40 score. It was sitting at 22%. They had decent growth but negative EBITDA due to rising paid media costs.

We reframed the brand budget as an investment in CAC efficiency.

We slowed down paid media spend, ran a focused brand campaign, and improved sales enablement.

CAC dropped by 18%.

Trust increased.

Sales cycles shortened.

The Rule of 40 score rose to 36% in six months.

Marketing didn’t just survive the cuts, but led the turnaround.

How to Calculate the Rule of 40

To calculate your Rule of 40 Score, you need two numbers:

Revenue Growth Rate (%)

EBITDA Margin (%)

Then you simply add them together:

Rule of 40 Score = Revenue Growth % + EBITDA Margin %

Let’s break down each one.

1. Calculate Revenue Growth Rate (%)

This tells you how much your revenue has grown year over year (YOY).

Step-by-step:

Get your revenue figures for this year and last year.

For example:Last Year’s Revenue = £10 million

This Year’s Revenue = £13 million

Subtract last year’s revenue from this year’s revenue:

£13m - £10m = £3m growthDivide that growth by last year’s revenue:

£3m ÷ £10m = 0.30Multiply by 100 to get the percentage:

0.30 × 100 = 30% Revenue Growth

Your Revenue Growth Rate = 30%

2. Calculate EBITDA Margin (%)

EBITDA = Earnings Before Interest, Taxes, Depreciation and Amortisation.

It gives a clearer picture of operational profitability, removing accounting and financing noise.

Step-by-step:

Get your EBITDA figure for the same year.

Let’s say EBITDA = £1.5 millionGet your total revenue for that year.

Revenue = £13 millionDivide EBITDA by revenue:

£1.5m ÷ £13m = 0.115Multiply by 100 to get the percentage:

0.115 × 100 = 11.5% EBITDA Margin

Your EBITDA Margin = 11.5%

Now calculate your Rule of 40 Score:

Revenue Growth = 30%

EBITDA Margin = 11.5%

Rule of 40 Score = 30% + 11.5% = 41.5%

That’s a strong score.

It signals healthy growth and operational discipline—exactly what investors and boards want to see.

Bonus Tip: What If Your EBITDA Is Negative?

Don’t panic. Many growth-stage companies operate at a loss.

If your EBITDA is -15%, but your growth rate is 55%, your Rule of 40 Score is still 40%—acceptable in many investors’ eyes.

The key is to balance growth and efficiency over time. High burn rates are tolerable if growth is exponential and the brand is strengthening its future value.

Summary

The Rule of 40 isn’t just a metric used by your CFO. It’s a strategic insight for marketers who want to shape the business agenda.

Understand it. Use it. Speak to it.

And you’ll go from marketing leader to growth architect and the kind of partner every CEO wants in the room.

Built to Last

Every Wednesday: Smart, sharp essays for marketers who want to lead with confidence and build businesses that grow sustainably.

Share this with a fellow marketer who’s ready to move from tactics to strategy.

Absolutely brilliant article Emma. In fact, despite having been CEO/MD of my own agency, worked with a respected business growth coach and directly alongside our accountant and financial advisors I have never heard of the rule of 40. Not a peep even mentioned. This is why I go on LinkedIn (where I got the link to this. ) Thank you for not being an echo chamber!!!