Ivor had pulled out Case Files to show how Charlie the CFO had cut brand budgets so tightly that Mary was close to strangulation.

Charlie sighed, folding his arms. “If marketing could explain its value in financial terms, we wouldn’t have this problem.”

Ivor realised this was where the issue was.

Mary and Charlie were speaking entirely different languages.

Mary had talked about brand perception, customer experience, and long-term loyalty.

Charlie talked about EBITDA, cost efficiency, and short-term revenue impact.

The result? A fundamental misalignment.

Ivor knew from his research that this wasn’t a lone case.

62% of CFOs say marketing should focus on short-term lead generation.

Only 26% of CFOs believe brand marketing is worth increasing investment.

80% of CFOs believe marketing struggles to prove its financial value.

Ivor looked up at the evidence on the wall.

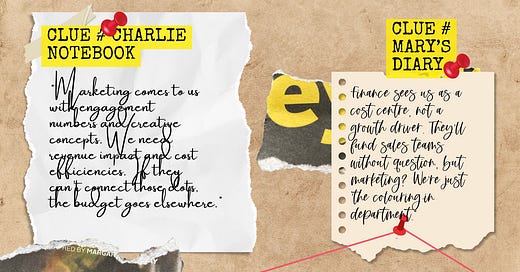

Clue: Quote from Charlie in his end-of-month report & Abstract from Mary’s diary.

Charlie had built a data-driven wall between Mary and the rest of the boardroom. Without a translator, Mary was locked out of key financial decisions.

Ivor slid another document across the table.

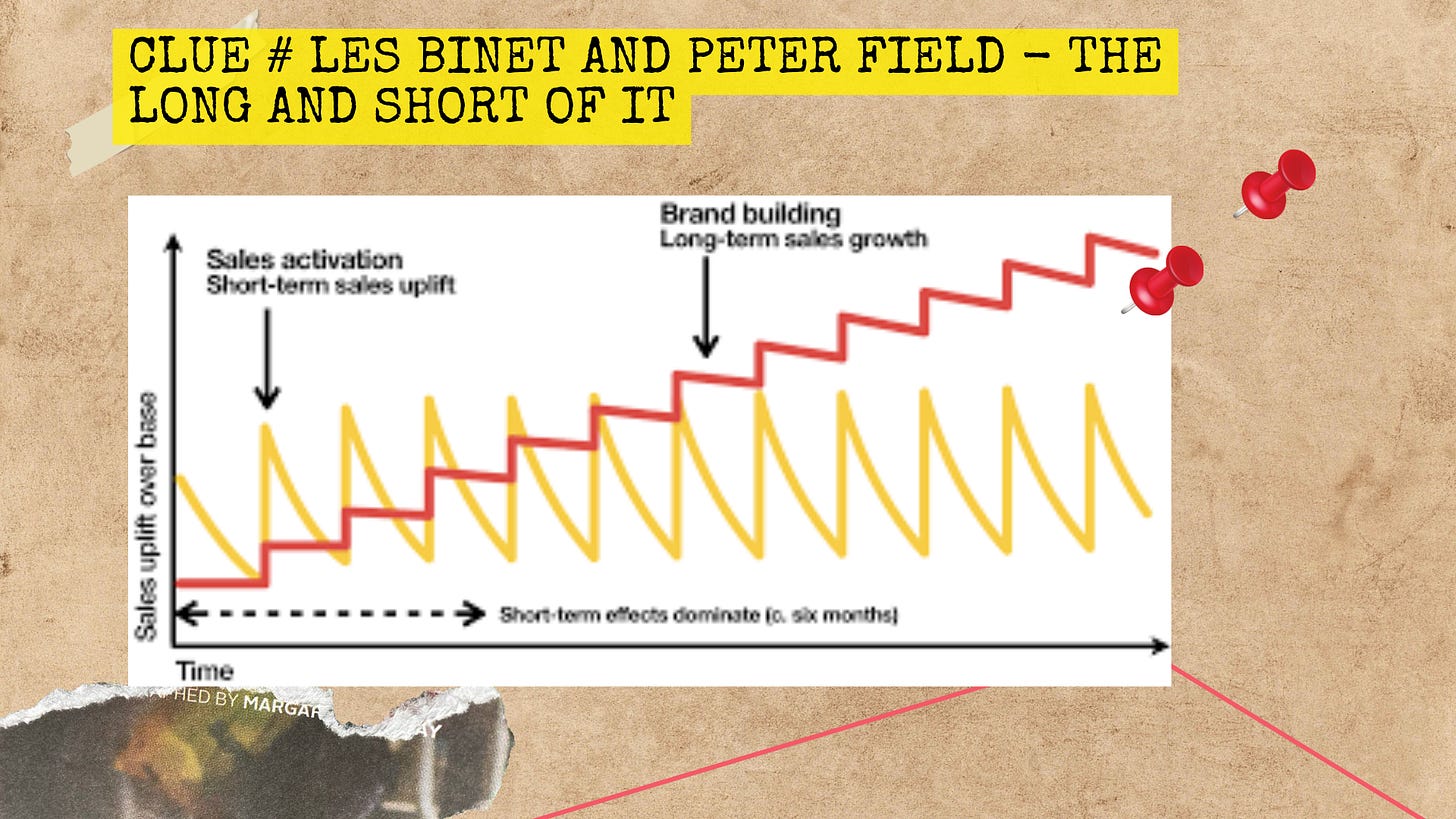

This time, a decade of research from Les Binet and Peter Field, proving that companies that maintain a balance of long-term brand investment (60%) and short-term activation (40%) drive significantly higher profitability over time.

Yet, CFOs have pushed the balance to nearly 80/20 in favour of short-term lead-gen.

Ivor cast his mind back to 2017.

He had investigated the crime scene after Procter & Gamble slashed their digital marketing spend by $200 million, assuming that they could maintain results without strong brand investment.

Within a year, they saw stagnating growth and lower brand differentiation. Realising their mistake, they reinvested heavily into brand marketing, and sales rebounded.

When presented with this exhibit, Charlie frowned. “So you’re saying we should have funded long-term brand campaigns with no immediate return?”

“Yes. That’s exactly what I am saying.” Ivor replied.

Charlie had suffocated Mary’s ability to function, shrinking her budget, demanding instant returns, and sidelining brand-building in favour of short-term lead generation.

“You didn’t pull the trigger,” Ivor admitted. “But you made sure Mary Marketing couldn’t breathe.”

Charlie leaned back, arms crossed. “It’s my job to keep the company profitable.”

And therein lay the problem. Mary Marketing was never supposed to be just an expense. She was meant to be an investment in future growth. But under Charlie’s watch, she had been reduced to a cost line, one that could be cut and disregarded whenever margins were tight.

The question wasn’t whether Charlie was guilty. The question was whether Mary Marketing could ever come back to the boardroom to convince the CFO of her true value before it was too late.

“No further questions.”

But Ivor wasn’t done yet.

To Be Continued…

Disclaimer: Who Shot Marketing? is a creative exploration of the challenges facing the marketing profession. All characters, events, and scenarios are fictional and intended for illustrative purposes only. Any resemblance to real persons, living or deceased, is purely coincidental.

To catch up on previous episodes and scenes, start here;